There are now hundreds of digital currencies with which users can move purely virtual money. However, one currency in particular has spread so far, namely Bitcoin. Unlike the euro or the dollar, there is no central bank to manage the money. Instead, the task is performed decentrally by Bitcoin users.

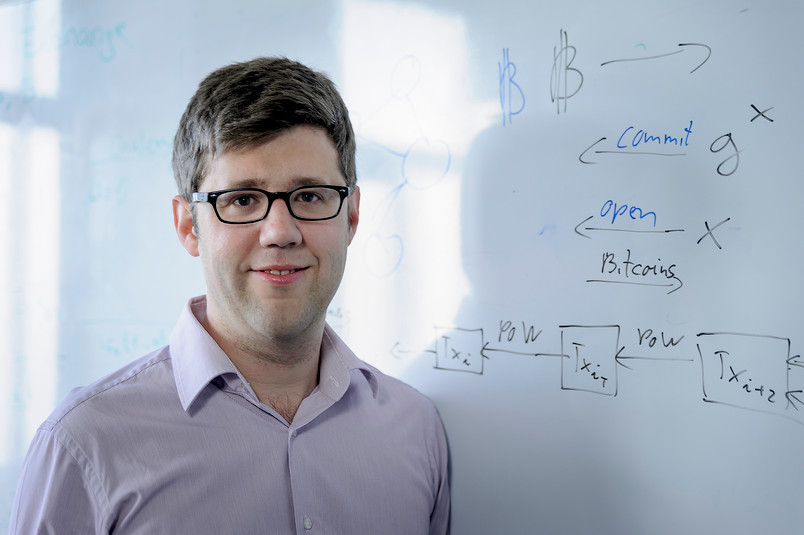

Professor Dr. Sebastian Faust from the Applied Cryptography group is interested in these digital currencies. To understand the questions he is researching, one must first look in more detail at how the system works.

In the Bitcoin network, individual users are assigned virtual amounts that can be transferred with the help of transactions. A particular challenge with digital currencies is stopping people from spending their virtual money twice. To prevent this and other fraud, the system has a sophisticated security mechanism.

Some of the users, called miners, collect and verify all transactions. They combine new transactions in a block and try to publish it in a freely accessible database, the blockchain. In the process, each miner wants to be the fastest, because: For each new block, he currently receives a financial reward of 25 Bitcoins, which, according to the conversion rate in May 2016, corresponds to about 10,000 euros.

Crypto puzzles guarantee security

In order for a miner to publish a block and thus ultimately validate it, he must first solve a cryptographic puzzle, the proof-of-work puzzle. This is difficult and requires a lot of computing power. Thus, all miners compete to publish the next block in each case. On average, this happens every ten minutes.

In the proof-of-work puzzle, the miners are given, in simple terms, a mathematical function whose output behaves like a random number. Their task is to find a specific input to this function so that the output of the function starts with a lot of zeros. The miners cannot approach the solution of the puzzle step by step, but have to try out many different inputs until they find a suitable one. To do this, they have to calculate constantly. But why the effort?

Since in principle all Bitcoin users can act as miners, it cannot be ruled out that they will acquire umpteen identities. Could these additional identities help solve proof-of-work puzzles, thus publishing blocks more often and making more profit? No, because only the computing power is decisive for that.

Hier geht es zum Originalartikel in den RUB News.